FactCheck: What did the Finance Minister tell Parliamentarians on Debt Servicing?

Madi Jobarteh and Finance Minister Hon Seedy Keita © Askanwi Media and MoFEA social media

By Yusef Taylor, @FlexDan_YT

A disagreement has erupted between the Ministry of Finance and Economic Affairs (MoFEA), Foroyaa Newspaper, and renowned civil society advocate Mr. Madi Jobarteh, resulting in claims and counterclaims that 80% of The Gambia’s debt is from the previous administration of President Yahya Jammeh.

Claim: Mr. Jobarteh posted a viral query questioning how “80% of the country’s debt was from the Jammeh era” when the finance minister reported back “in April 2024” that the country’s “debt was D46.3 billion by 2016.” Mr. Jobarteh revealed that the Finance Minister added that “from 2017 to Dec 2023, [debt] increased to a staggering D110.6 billion.”

Below is a screenshot of the post.

Counterclaim: This prompted a very quick rebuttal from the MoFEA social media account, which claimed that “80% of the debt service allocation in the 2026 Budget relates to debts acquired before 2017.”

The MoFEA also accused both Foroyaa Newspaper and Madi Jobarteh of peddling “fake news”. They concluded by stating, “We respectfully encourage Mr. Madi Jobarteh, Foroyaa Newspaper and the general public to verify information before sharing so that public discussions remain factual and responsible.”

Below is a screenshot of the post.

FactCheck

This publication aims to ascertain the Finance Minister’s statement in Parliament on the country’s debt situation, Foroyaa Newspaper’s publication and Madi Jobarteh’s claims. Some additional information has been provided on the country’s current debt situation.

The current administration of President Adama Barrow came into power at the start of 2017 after defeating former President Yahya Jammeh in late 2016. Former President Jammeh is alleged to have embezzled billions of dalasis worth of funds and assets, according to the Janneh Commission.

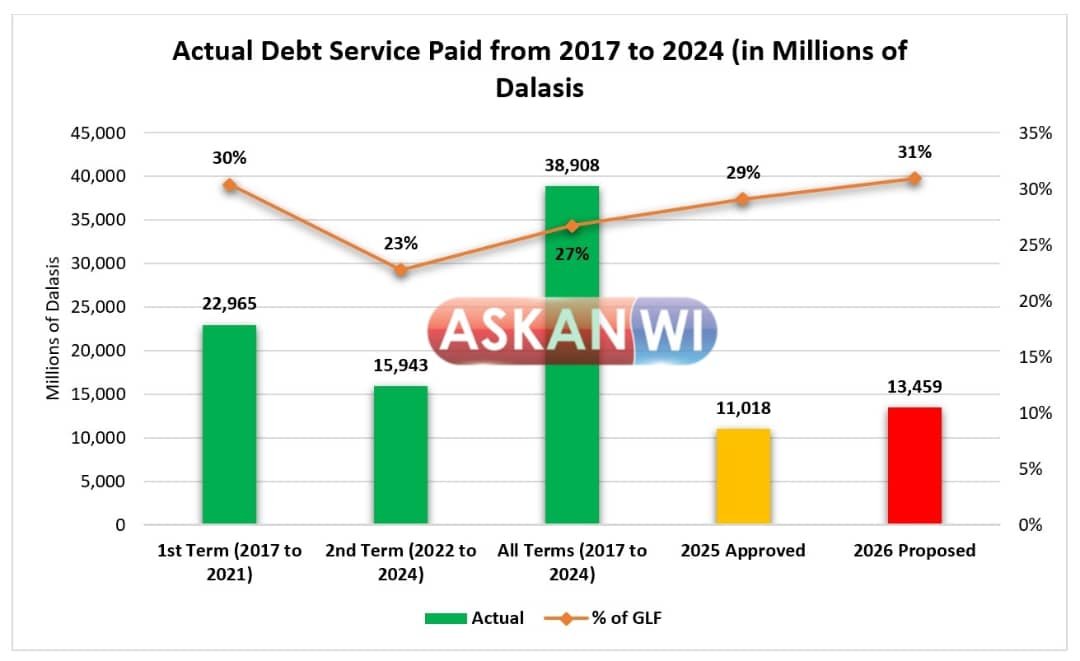

Next year will feature a crucial presidential election, which is the backdrop for the Finance Minister tabling his 2026 Draft Budget, proposing D13.5 billion to be spent on Debt Service next year. He was questioned by Parliamentarians about the 2026 Debt Service consuming 30.95% of the Government’s Local Funds (GLF). This will leave less than 70% of GLF for Development and Recurrent Expenditures.

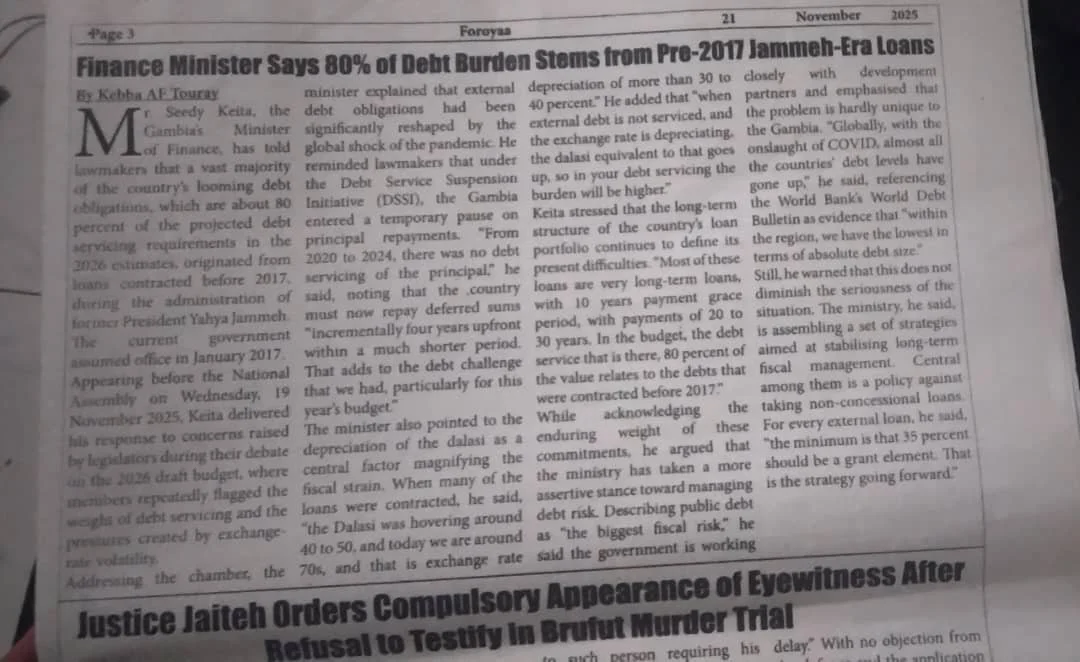

Foroyaa Newspaper Publication © Foroyaa Newspaper

Foroyaa Newspaper Publication

A day after the minister’s statement, a Foroyaa Newspaper article was published on the front page headlined, “Finance Minister says 80% of Debt Burden Stems from Pre-2017 Jammeh-Era Loans.” Inside page 3 of the newspaper is the full article, which quotes the finance minister saying, “In the budget, the debt service that is there, 80 percent of the value, relates to debts that were contracted before 2017.”

Watch the video in the link: https://www.facebook.com/share/v/1BXF41tbxP/

After watching the video of Finance Minister Hon. Seedy S. Keita, speaking in Parliament on Wednesday, 19th November 2025, was heard clearly saying, “In the budget, the debt service that is there, 80% of the value, relates to debts that were contracted before 2017.”

“In the [2026 Draft] Budget”

Our observations are that the Foroyaa Newspaper reporter quoted the Finance Minister accurately. The Finance Minister failed to clearly state “in the [2026 Draft] Budget,” which he claimed was stated in their social media post.

Perhaps one could argue that because the Finance Minister stated “in the budget,” the only budget being discussed on 19th November 2025 was the 2026 Draft Budget. This could have prompted the reporter to include the [2026 Draft] Budget in brackets, indicating that this is an inclusion or inference in their write-up.

Verdict: The MoFEA’s social media claim that Finance Minister Keita stated “80% of the debt service allocation in the 2026 Budget relates to debts acquired before 2017” is MISLEADING.

The Finance Minister actually said, “In the budget, the debt service that is there, 80% of the value, relates to debts that were contracted before 2017.”

Verdict: MISLEADING.

Facts on Debt Service and National Debt Stock

There is a difference between the total National Debt Stock, sometimes referred to as the Public Debt Stock, and the Debt Service paid yearly.

National Debt Stock refers to the country’s total debt, which has been accumulated from domestic and international sources. It is the total of the country’s entire debt. Last year the Finance Minister held a press conference and released a statement announcing that by the end of 2023 the country’s National Debt had increased from D46 billion by the end of 2016 to approximately D111 billion by the end of 2023.

Below is the chart from the Ministry of Finance and Economic Affairs.

Public Debt Stock from 2016 to 2023 © MoFEA

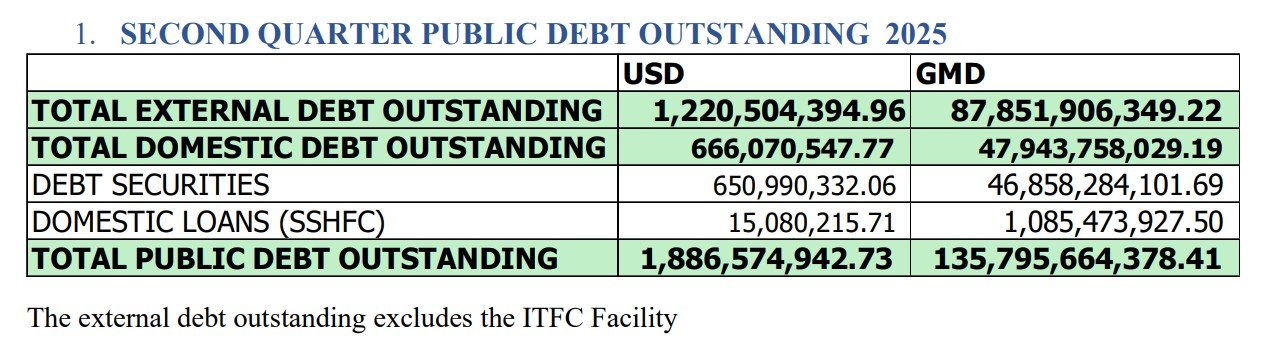

A more recent Debt Bulletin published by the MoFEA has revealed that the latest National Debt Stock stands at D135.796 billion dalasis by the end of June 2025. However, this amount is not the total debt because the Debt Bulletin clearly states that “the external debt outstanding excludes the ITFC Facility.”

June 2025 Debt Bulletin © MoFEA

Debt Service refers to the country’s yearly allocation to pay off debts. This is the amount that the government pays to all its international and local partners within the period of a year. The Gambia’s 2026 Draft Budget proposes a Debt Service of D13.5 billion for next year. Last year Parliament approved D11 billion to be paid in debt service in 2025.

Below is a chart showing the country’s actual debt service paid every year from 2017 to date.

Debt Service paid (in green) approved and proposed Debt Service (orange and red) digitised by Askanwi Media after MoFEA.

Actual Debt Service paid in 1st and 2nd terms (green) and Approved and Proposed Debt Service for 2025 and 2026. Digitised by Askanwi Media after MoFEA

Conclusion

Verifying the finance minister’s claims that 80% of the country’s D13.5 billion Debt Service was contracted before 2017 needs additional information from the MoFEA. Pages 313 to 320 of the 2026 Draft Budget include a list of all the debt proposed to be paid next year; however, only four out of hundreds of entries have a year indicated next to them. The rest of the entries all have a loan code allocated to them.

If every single debt itemised to be paid in the 2026 Draft Budget includes the year it was contracted, then parliamentarians and the public can tabulate the data and verify the finance minister’s claims. Better still, given that the finance minister made these claims, the onus falls on him to substantiate his claims. Most importantly, given the lack of data from the finance minister, parliamentarians have a responsibility to request information backing the finance minister’s claim that 80% of the D13.5 billion Debt Service was indeed “contracted before 2017.”