D13.4M Missing: Financial Irregularities Exposed Amid Gamtel/Gamcel Job Cuts

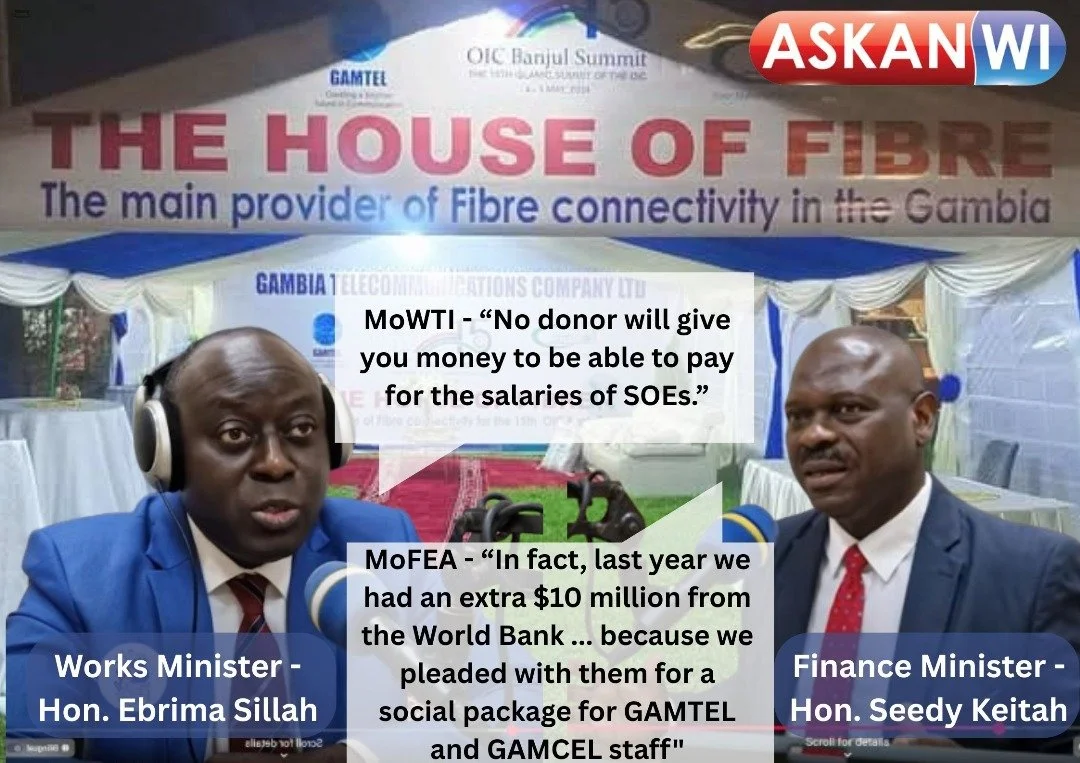

Infrastructure Minister Sillah and Finance Minister Keita © Askanwi - First FactCheck on the issue https://www.askanwi.com/feature-publications/factcheck-delayed-gamtel-salaries-raise-doubts-10m-world-bank-funds

By Edward Francis Dalliah

More than 700 employees of Gambia Telecommunications Company (GAMTEL) and its mobile subsidiary GAMCEL are facing redundancy under a sweeping reform and privatisation plan. However, the looming layoffs come at a time of mounting financial distress within the state-run telecom giants—including chronic salary delays and over D13.4 million in unpaid staff credit union contributions—raising serious concerns about transparency and staff welfare during the transition.

Appearing before the National Assembly on Tuesday, 24th June 2025, the Minister for Communications and Digital Economy, Hon. Lamin Jabbie, confirmed that a World Bank-backed social plan is underway. It aims to place affected employees on voluntary redundancy or early retirement, with compensation measures intended to cushion the impact of job losses.

An internal government document reviewed by Askanwi Media, titled “Draft Social Plan & Grievance Redress Mechanism for Gamtel/Gamcel” and dated June 2024, reveals that out of a total workforce of 1,056 employees, 706 are set to be made redundant across all departments. The document outlines a target merged workforce of just 350 staff following the restructuring.

The estimated total cost of the Social Protection Plan—including a 2% contingency—is GMD 435,456,654.60 (approximately $6.49 million).

However, a prior announcement by the Finance Minister, Hon. Seedy S. Keita, indicated that $10 million had been approved by the World Bank for the package—raising questions about the allocation and use of funds.

For employees still on the payroll, the financial strain is worsening. May salaries were only paid around the Tobaski holiday after considerable delays, and June salaries have reportedly not been received by some staff as of the 26th—despite expectations of timely payment.

These continued delays are compounding hardship for employees already grappling with missing credit union contributions. Although the government says the social plan will address financial concerns for staff—particularly those facing redundancy—the current situation tells a different story.

A report titled “Report on Gamcel Credit Union Arrears”, obtained by Askanwi, reveals that as of 31st December 2024, GAMCEL owed D13,400,372.11 in unremitted employee contributions to the Gamtel Credit Union. These deductions, taken directly from staff salaries, were never transferred—leaving many workers unable to access their savings or credit facilities when they need them most.

This finding validates a January 2025 petition filed by concerned Gamcel employees, who demanded answers and accountability regarding the missing funds.

The four-page report—compiled through a joint reconciliation effort by Gamcel’s Financial Accountant, Treasury Office, and the Credit Union’s Finance Manager—uncovers systemic payroll irregularities, including:

Discrepancies between payroll schedules submitted to the Credit Union and those forwarded to the Treasury for payment

Incomplete payments rolled over from previous periods

Duplicate deductions over three months for Islamic Credit Union members

Unpaid monthly staff savings, deducted from salaries but never remitted

Despite these revelations, little visible progress has been made in resolving the backlog. With 706 employees scheduled to be let go by 31st October 2025, staff warn that they are being pushed out without adequate compensation or clarity.

The Credit Union report recommends immediate dialogue between Gamcel management and the Credit Union Board. It also suggests transitioning from payroll-based deductions to personal bank standing orders to prevent further lapses.

As the privatisation of Gamtel and Gamcel moves forward, employee confidence is crumbling. Salary delays have become routine. Combined with unpaid credit union contributions and looming job losses, workers feel abandoned—left not only to face redundancy, but to do so without being fully compensated for their work.

What began as a reform initiative now risks escalating into a full-blown labour and credibility crisis. For many of the affected staff, the question is no longer if they will lose their jobs, but whether the company will honour its obligations before they do.